If you’re a first-time home buyer, you may be wondering: Should you purchase a small starter home to get into the market now, knowing you may grow out of it in a few years? Or, should you stretch your budget — or spend more time saving — to get a “forever home” that will take care of your long-term needs?

Here are some factors to consider as you weigh whether to get a home best suited for the short term or the long haul.

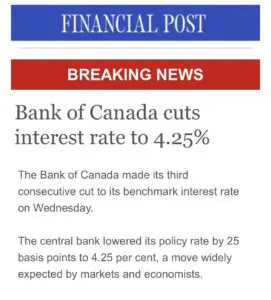

• Market conditions: Mortgage rates are historically low, but there’s no telling how long that will last. Also, many real estate markets nationwide are booming; consider whether to jump in before home prices get even higher, or whether they may weaken.

• Where you want to live: Consider if you’d be OK living for a few years in the suburbs, where you might be able to find something more affordable, or if you’d rather try to snag a home in a different area where you want to live long-term

• How much house you can afford: It ultimately comes down to how much money you have saved and how much you can afford to spend on a monthly mortgage payment. Use a home affordability calculator to see what’s within your price range.

• What kind of house you want: For a starter home, you might go for an apartment, condo or townhouse in an up-and-coming area. If you’re thinking forever home, a single-family detached or a house with land to build an addition later could be a better fit — but it’ll be more expensive.

• The costs of getting out early: If you do spring for a starter house now, and you end up getting married or having kids or needing to move quickly, you may face penalties, such as capital gains tax

Those are some of the big-picture considerations. Let’s dive into the details on what else you need to think about.

Starter home considerations

Your lifestyle: Do you want to be in the middle of a big city, or are you fine with the ’burbs if that means you can own a home? If you want to live centrally, where real estate is most expensive, you’ll probably have to start small. Dana Bull, a real estate agent in Boston with Harborside Sotheby’s International Realty, remembers when she bought her first condo at 22, she could afford only one well outside of Boston, and she had some regret as she missed being in the city near her friends. Consider what you’re willing to sacrifice, both in terms of location and size.

Your future needs: Bull says many first-time home buyers assume they’ll be in a home much longer than they actually are. She says young, single people sometimes don’t realize how quickly life can change. A job switch, new relationship or new baby can alter what you need in a home.

Zachary Conway, a financial advisor with Conway Wealth Group LLC in Parsippany, New Jersey, adds that selling a house can be stressful — especially if you’re in the midst of major life changes such as having a baby.

So, if your life is full of flux and you think you would stay in your starter home for only 1 1/2 to three years, it may be less stressful to keep renting until you’re ready for something large enough to meet longer-term needs.

Capital gains taxes: If you set out to buy a starter home for the short term, be careful, Bull says. If you sell soon after moving in, you may owe capital gains tax on your profit from selling the home.

According to the IRS, individuals are excluded from paying taxes on $250,000 ($500,000 if married) of gain on a home sale as long as the house was used as your main residence during at least two of the five years before selling it. That means you may want to think carefully about buying a home you’ll grow out of in less than two years. Consult a tax professional to see how this could affect you.

Consider an exit strategy: If you’re considering going the starter home route, you should think through from the start how you’ll offload it when the time comes to move, Bull says. For instance you might buy a property that you could rent out to cover your mortgage, especially during times of economic uncertainty, she says. This helps ensure you can cover your mortgage payment if you need to move ASAP, or if the market is weak when you hope to sell but you don’t want to take a loss.

You should also carefully research the area in which you’re looking to buy, Conway says, and confirm “there’s enough resale potential to make sure that even in a market that’s heading downward, you still have a likelihood of being able to get out of where you are.”

Forever home considerations

Interest rates: Conway says that if you decide to wait so you can afford a forever home, there’s a chance interest rates could increase from their current historic lows. “You might be able to scrape together some additional funds in the next few years, but maybe at that point, we may be closer back to historical norms of interest rates, and your mortgage is more expensive,” Conway says. Nobody can predict what will happen, but it’s important to keep a pulse check on mortgage rates.

Hot markets: In many major cities such as Boston, property values are rising rapidly, Bull says. There’s also a lot of uncertainty as to whether home values will plateau or keep going up, leaving first-time home buyers wondering if they should give in to the “feeding frenzy,” she says. If you wait in hopes of saving for a larger home, it’s possible prices will rise faster than you can save, she says.

Your cash flow: Considering your lifestyle and life events is certainly important, “but really at the end of the day, it comes down to the math of do we have the cash flow,” Conway says.

If you want a forever home, you have to ask yourself whether you can afford the larger down payment, and whether your salary supports a higher monthly mortgage payment. Conway says it’s key to create a budget and to carefully track what you save and spend, and to be sure you can afford a more expensive home. Don’t assume your salary will be higher in a few years and go for a bigger mortgage, he says. And don’t forget to factor in higher ongoing expenses like property taxes and homeowners insurance.

» MORE: Calculate your monthly mortgage payment

Don’t stress too much

While making the decision between a starter home and forever home is a major move, Bull says don’t fret too much about making the wrong decision. Remember, she says, “there are always options — you can sell, you can rent, you can put yourself in a position where you can go out and buy another house.”

Conway adds that if you decide you’re not ready to buy for a while, that’s OK too, and you shouldn’t look at rent as throwing away money. “I wouldn’t jump into buying something for the sake of the fact that’s what we were told we should do,” he says. “It really comes down to what you’re comfortable with from a cash flow standpoint and what you want in your life. There’s nothing inherently wrong with paying rent.”

The article Buying Your First House: Starter Home or Forever Home? originally appeared on NerdWallet.